By Chris Brown, Attorney & Founder of Pixel Law

By Chris Brown, Attorney & Founder of Pixel Law

Some of the most frequent tax questions entrepreneurs have are about S-Corps. For freelancers and many small businesses, S-Corps can be a great option. But for many startups, they can create significant challenges.

This guide will help you decide if an S-Corp is right for your business. It’s divided into three parts:

- What’s an S-Corp

- When S-Corps Are Good (or Bad)

- How to Reduce Taxes Using an S-Corp

1. What is an S-Corp

A Little History (You Can Skip to “S-Corp Restrictions” if You Want)

Historically, entrepreneurs only had two options to form a business entity (we’ll ignore LLCs for a moment, as they’re only a few decades old):

- Form a general partnership and (a) benefit from a reduced tax bill due to “pass-through” taxation, but (b) be subject to personal liability for all business debts and liabilities, or

- Form a corporation and (a) benefit from limited personal liability for all business debts and liabilities, but (b) be subject to a higher tax bill due to “double-taxation.”

Neither option is ideal. One gives higher income but higher risk, while the other offers less risk but lower income. In the 1950s, President Eisenhower led an effort to create a hybrid option: allow a corporation to “pass through” its income while still benefiting from the limited liability associated with corporations. Congress agreed and enacted Subchapter S of the IRS Code in 1958. As a result, business owners could form a corporation, make an S-Corp election, and receive both a lower tax bill and limited liability.

But here’s something important to remember—an S-Corp is not a business entity.

When you form your business entity with your Secretary of State, you can choose partnership, limited liability company, corporation, or non-profit corporation. But you cannot choose “S-Corp.” That’s because it is simply a tax classification.

S-Corp Restrictions

It is very important to note that there are specific requirements you must meet if you want to take advantage of S-Corp taxation. These requirements are not ideal for many businesses, especially high-growth startups that want to raise venture capital.

To qualify for S-Corporation status today, a corporation must:

- Be a domestic corporation

- Have only allowable shareholders (individuals, certain trusts, and estates are permitted, while partnerships, corporations, and non-resident aliens are not permitted)

- Have no more than 100 shareholders

- Have only one class of stock

- Not be an ineligible corporation (i.e., certain financial institutions, insurance companies, and domestic international sales corporations).

The Lawyer's Guide to Entrepreneurship

Maximize your success with the right legal foundation.

2. When S-Corps Are Good (or Bad)

When S-Corps May Be Good

Two types of businesses are most likely to benefit from an S-Corp election:

- Freelancers who operate using an LLC or Corporation and make more than a “reasonable” salary for their given profession.

- Small businesses owned by individuals (rather than owned other business entities) with simple legal structures.

These kinds of businesses probably meet the requirements to be an S-Corp (see above) and are unlikely to change their business structure in the future. That’s important because if you make a change to your business and fail to meet the requirements, you’ll lose your S-Corp status and may face serious financial consequences as a result.

After making the S-Corp election, these businesses will gain two primary benefits: (i) they can avoid paying corporate taxes on the business’s income and instead “pass through” all the income to the owners’ individual tax returns, and (ii) they can reduce their tax bill by treating part of their income as profit distributions (see below).

Learn more about business taxes.

When S-Corps May Be Bad

Sometimes, making an S-Corp election can be a really bad idea.

Specifically, many businesses don’t meet the requirements noted above (for example, they are owned by an ineligible owner, have multiple ownership classes, etc.). In those scenarios, it’s pretty obvious that they shouldn’t make an S-Corp election.

In other cases, you may meet the requirements, but it still might not make sense to make the S-Corp election. This is especially true for high-growth startups that need to raise money from investors. An S-Corp can only have 100 owners (which means you probably can’t go public), it can’t be owned by most types of business entities (which means many investors can’t invest in the company), and it can’t have more than one class of ownership (which means you can’t grant preferred stock to your investors).

3. How to Reduce Taxes Using an S-Corp

The Default 15.3%

When you earn money, the government expects to collect 15.3% for Social Security and Medicare (in addition to other business and individual taxes).

If you are employed, you’ll pay 7.65% and your employer will pay the other 7.65%. However, if you are self-employed, you have to pay the entire 15.3% yourself. This is true for Sole Proprietors and partners in a Partnership (and also true for LLC owners if the LLC is taxed as a Sole Proprietorship or Partnership). There are some limits to this, plus you’ll pay various income taxes and other taxes. But we’re trying to keep things simple here.

The S-Corp Exception

When you elect to be taxed as an S-Corp, the government will collect that 15.3% on your salary, but you can pass your profits through to your personal tax return without paying that 15.3% on those profits. That’s where the savings comes in. Saving 15.3% of your profits can add up significantly in some situations.

A Practical Example

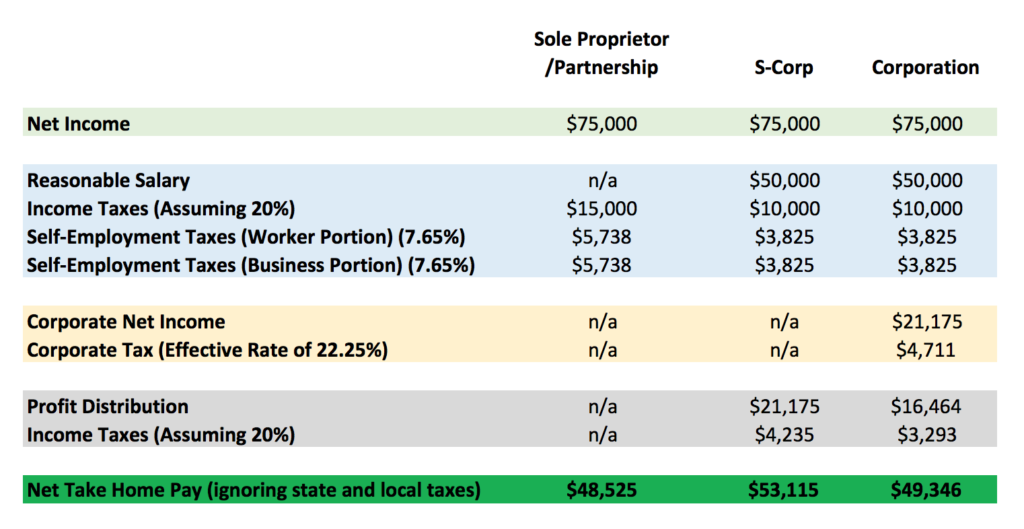

In the example below, I show what federal taxes you’ll owe based on $75,000 in net income. This example assumes your individual tax rate is 20% and that your effective corporate rate is 22.25%. It also ignores state and local taxes.

*Please note that this is an overly simple example. It doesn’t factor in every kind of deduction, etc. I’m trying to get to the heart of the benefits of S-Corps without getting too far into the weeds.

As you can see, your tax classification will impact how much money you take home at the end of the year.

Being taxed as a Sole Proprietor is the easiest, but not the most profitable. Paying taxes as a Corporation might look better, but in the real world, it is more expensive to operate as a Corporation, so you won’t really see a savings there (corporate formalities, additional state-level taxes, extra tax return filings, etc.).

However, in the middle, you’ll see how the S-Corp election can save you money. You can avoid corporate taxes and the 15.3% self-employment tax on your profits. At the end of the day, at least in this simple example, your net take-home pay will be highest by making an S-Corp election.

What This Means for You

Clearly, making an S-Corp election can result in more money in your pocket at the end of the year. But as explained above, there are other reasons why you might not want to make the election.

Further, even in this simple example, it is all quite complicated. And there is more to it than described here. That’s why you should always talk with an accountant and a lawyer before making any tax classification decisions for your small business, especially if you are a high-growth startup.

*This article is general in nature and is not legal advice.

The Lawyer's Guide to Entrepreneurship

- LLCs & Corporations

- Finance & Taxes

- Hiring People

- Intellectual Property

- Contracts

- And more!